FX

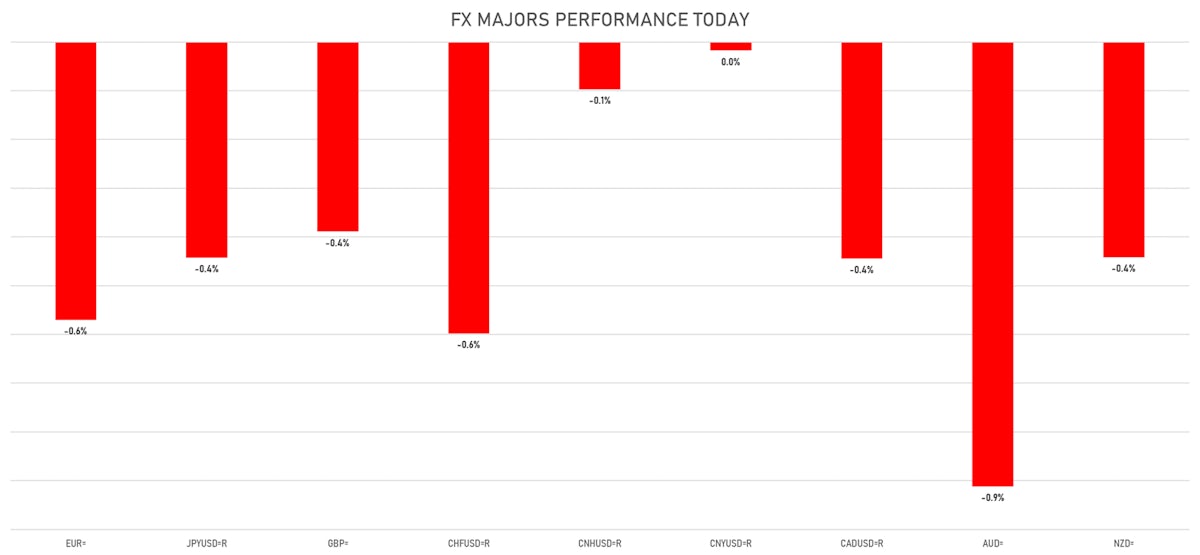

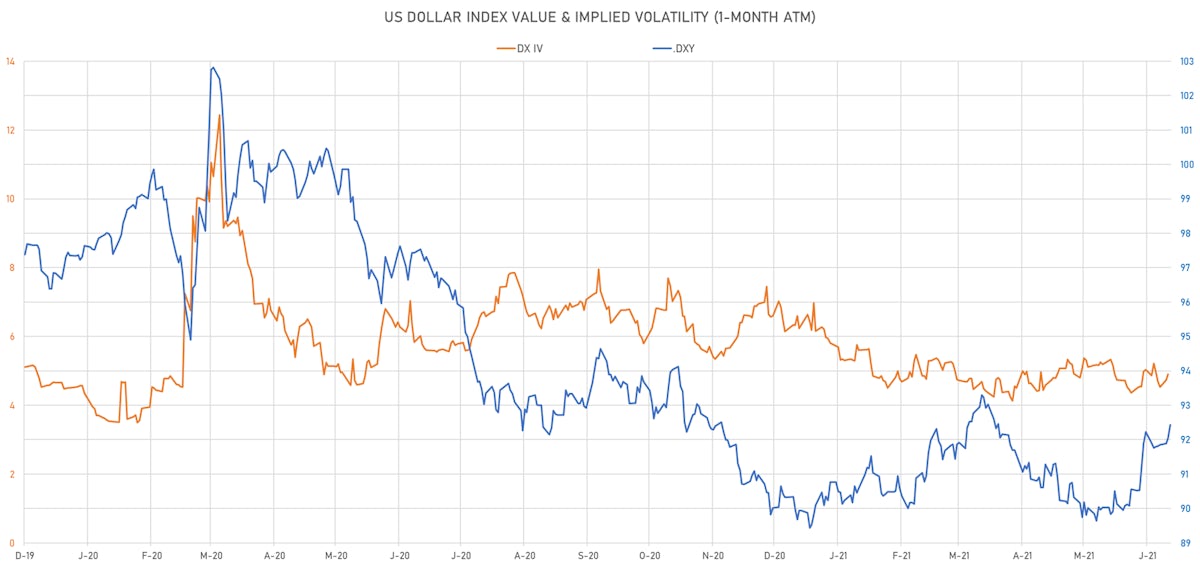

The US Dollar Index Was Up Across The Board Today, Up 2.7% For 1H'21

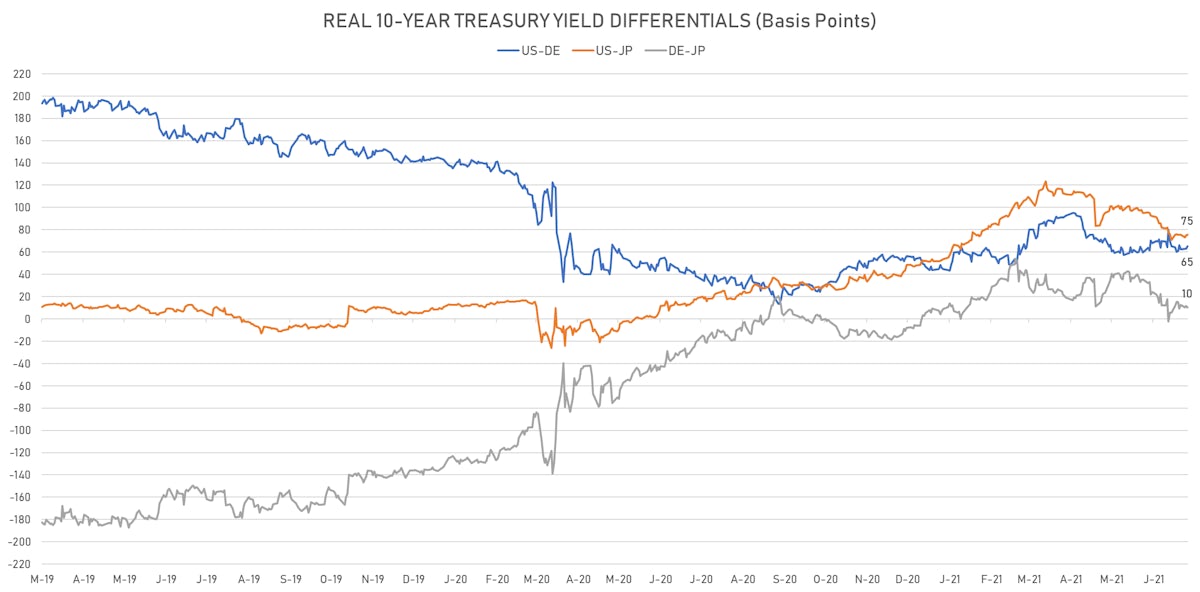

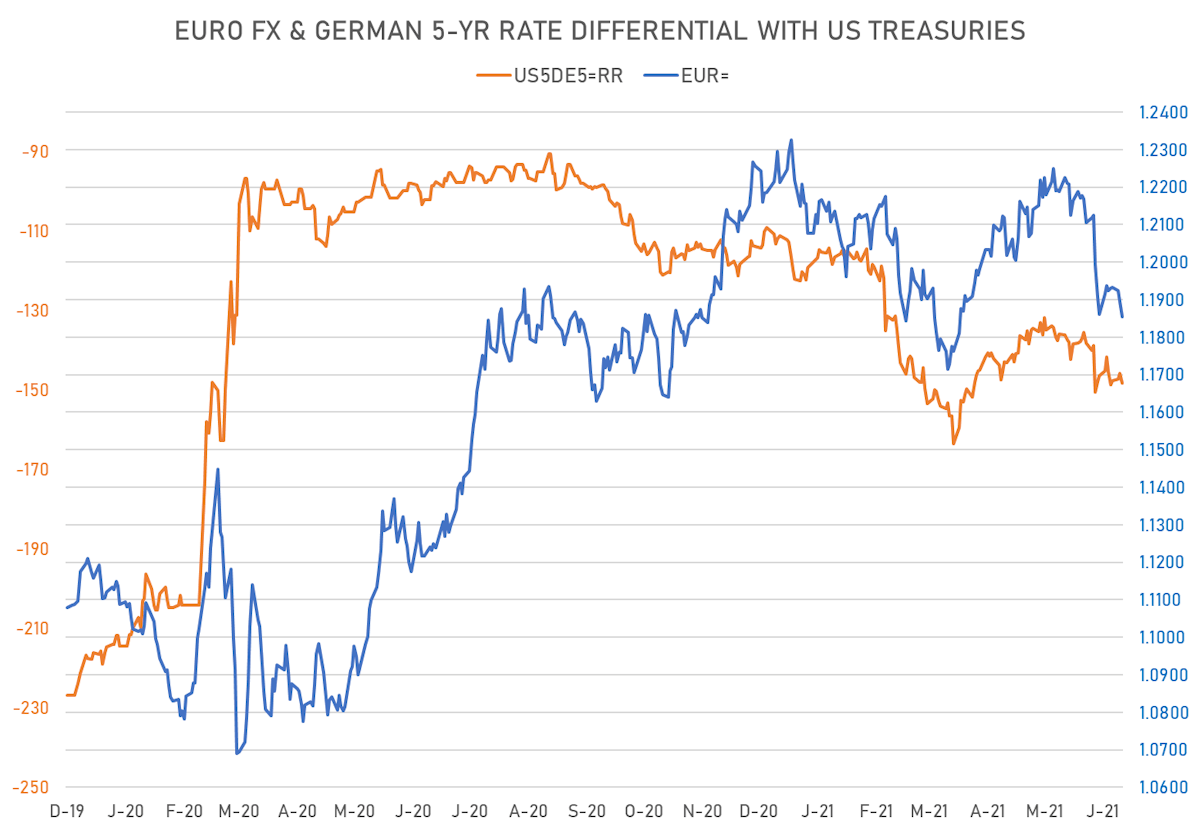

US rates were weak today and weaker still abroad, with sovereign rates differentials widening with Germany and Japan

Published ET

FX performance at the end of the first half 2021 | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.42% at 92.44 (YTD: +2.78%)

- Euro down 0.55% at 1.1858 (YTD: -2.9%)

- Yen down 0.42% at 111.10 (YTD: -7.1%)

- Onshore Yuan down 0.02% at 6.4566 (YTD: +1.1%)

- Swiss franc down 0.60% at 0.9248 (YTD: -4.3%)

- Sterling down 0.40% at 1.3828 (YTD: +1.1%)

- Canadian dollar down 0.49% at 1.2396 (YTD: +2.7%)

- Australian dollar down 0.89% at 0.7500 (YTD: -2.5%)

- NZ dollar down 0.50% at 0.6989 (YTD: -2.7%)

MACRO DATA RELEASES

- Canada, GDP, All industries, Change P/P for Apr 2021 (CANSIM, Canada) at -0.30 %, above consensus estimate of -0.80 %

- China (Mainland), PMI, Manufacturing Sector for Jun 2021 (NBS, China) at 50.90 , above consensus estimate of 50.80

- Denmark, GDP, Total, chain linked, Change P/P for Q1 2021 (statbank.dk) at -1.00 %

- Denmark, GDP, Total, chain linked, Change Y/Y for Q1 2021 (statbank.dk) at -0.80 %

- Denmark, Unemployment, Rate, Net for May 2021 (statbank.dk) at 3.60 %

- Euro Zone, CPI, Change Y/Y for Jun 2021 (Eurostat) at 1.90 %, in line with consensus estimate

- Euro Zone, CPI, Total excluding energy and unprocessed food, Change Y/Y, Price Index for Jun 2021 (Eurostat) at 0.90 %, in line with consensus estimate

- France, HICP, Flash, Change Y/Y, Price Index for Jun 2021 (INSEE, France) at 1.90 %, in line with consensus estimate

- Germany, Unemployment, Change, Absolute change for Jun 2021 (Deutsche Bundesbank) at -38.00 k, below consensus estimate of -20.00 k

- Germany, Unemployment, Rate, Registered for Jun 2021 (Deutsche Bundesbank) at 5.90%, in line with consensus estimate

- Italy, HICP, Preliminary, Change P/P, Price Index for Jun 2021 (ISTAT, Italy) at 0.20 %, in line with consensus estimate

- Italy, HICP, Preliminary, Change Y/Y, Price Index for Jun 2021 (ISTAT, Italy) at 1.30 %, below consensus estimate of 1.40 %

- Japan, TANKAN, Business Conditions, Diffusion Index, Large enterprises, manufacturing, actual, Price Index for Q2 2021 (Bank of Japan) at 14.00 , below consensus estimate of 15.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Large enterprises, manufacturing, forecast, Price Index for Q2 2021 (Bank of Japan) at 13.00, below consensus estimate of 18.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Large enterprises, nonmanufacturing, actual, Price Index for Q2 2021 (Bank of Japan) at 1.00, below consensus estimate of 3.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Small enterprises, manufacturing, actual, Price Index for Q2 2021 (Bank of Japan) at -7.00, below consensus estimate of -5.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Small enterprises, manufacturing, forecast, Price Index for Q2 2021 (Bank of Japan) at -6.00, below consensus estimate of -3.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Small enterprises, non-manufacturing, actual, Price Index for Q2 2021 (Bank of Japan) at -9.00,in line with consensus estimate

- Japan, TANKAN, Business Conditions, Diffusion Index, Small enterprises, nonmanufacturing, forecast, Price Index for Q2 2021 (Bank of Japan) at -12.00, below consensus estimate of -8.00

- Japan, TANKAN, Fixed Investment, Large enterprises, all industries, forecast for current Fiscal Year, Change Y/Y for Q2 2021 (Bank of Japan) at 9.60 %, above consensus estimate of 7.20 %

- Japan, TANKAN, Fixed Investment, Small enterprises, all industries, forecast for current Fiscal Year, Change Y/Y for Q2 2021 (Bank of Japan) at 0.90 %, above consensus estimate of -2.60 %

- Russia, Unemployment, Rate for Apr 2021 (RosStat, Russia) at 4.90 %, below consensus estimate of 5.00 %

- Switzerland, KOF composite leading indicator for Jun 2021 (KOF, Switzerland) at 133.40 , below consensus estimate of 144.70

- Switzerland, Reserves, Official reserve assets, Current Prices for May 2021 (Swiss National Bank) at 966,285.42 Mln CHF

- United Kingdom, GDP, Total, at market prices, Change P/P for Q1 2021 (ONS, United Kingdom) at -1.60 %, below consensus estimate of -1.50 %

- United Kingdom, Total, Final, Change Y/Y for Q1 2021 (ONS, United Kingdom) at -6.10 %, in line with consensus estimate

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 2.5 bp wider at -148.2 bp (YTD change: -37.1 bp)

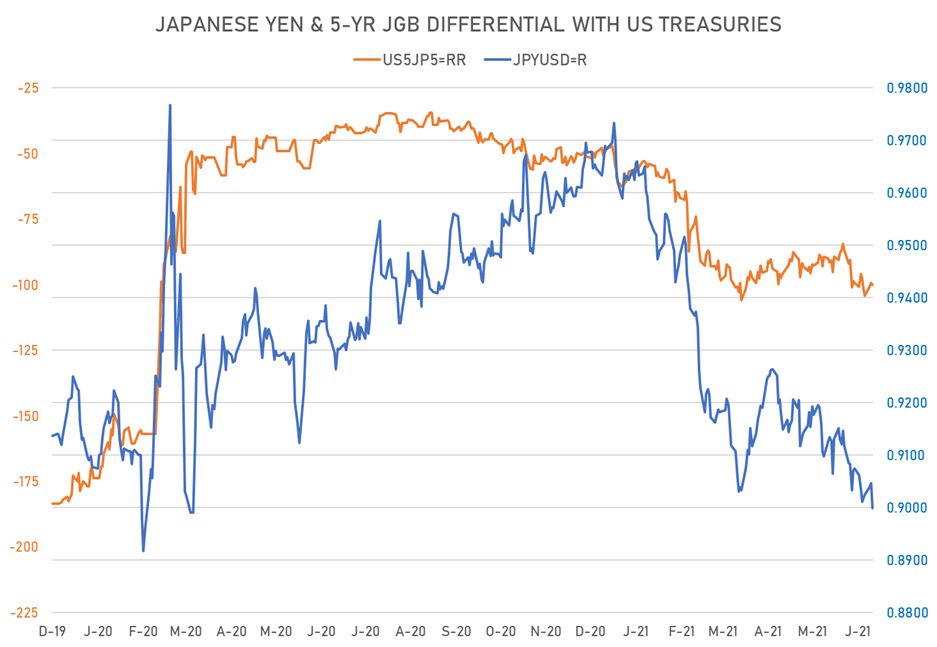

- 5Y Japan-US interest rates differential 0.7 bp wider at -100.0 bp (YTD change: -51.7 bp)

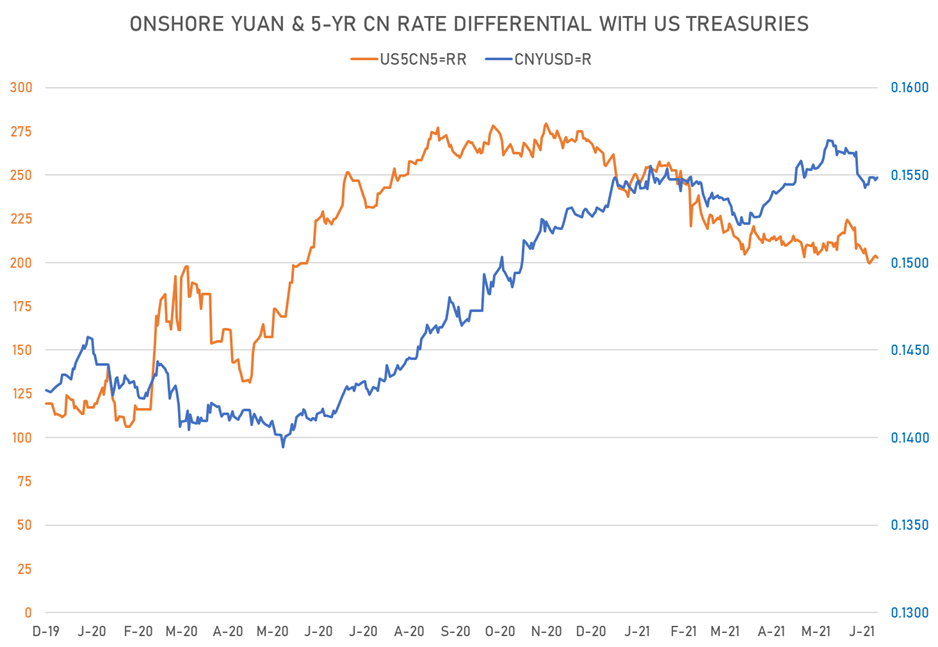

- 5Y China-US interest rates differential 1.3 bp tighter at 202.7 bp (YTD change: -54.4 bp)

VOLATILITIES

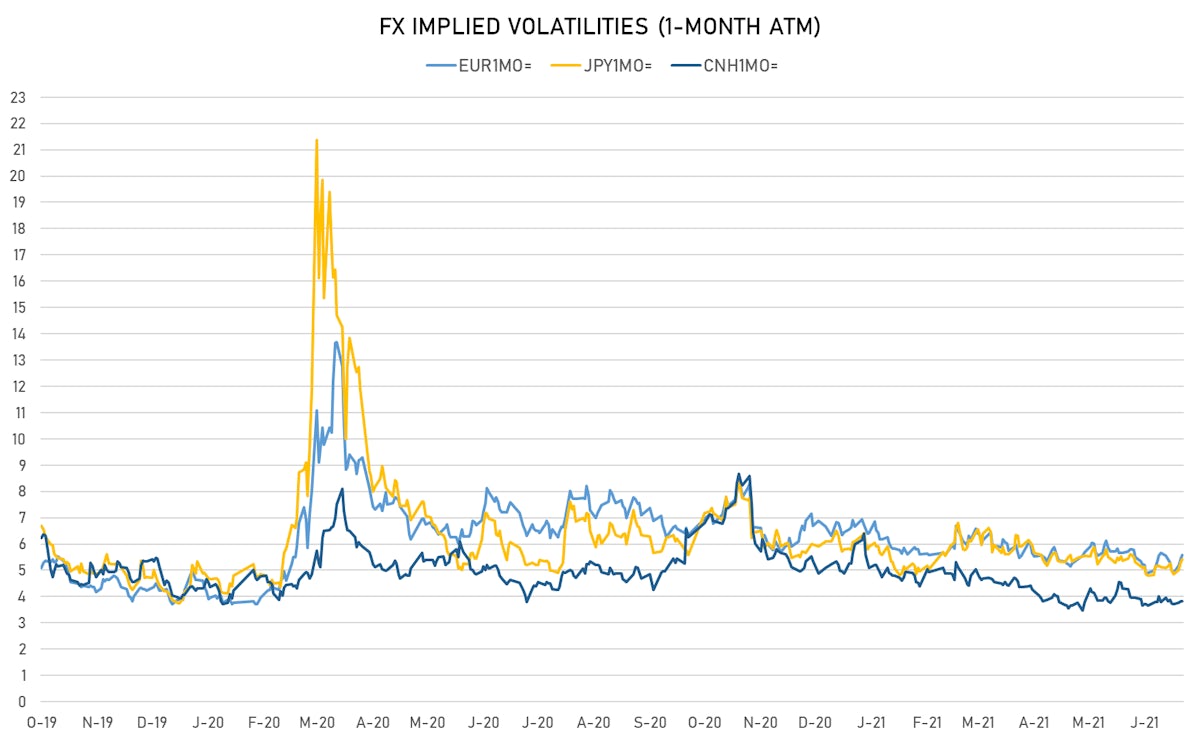

- Deutsche Bank USD Currency Volatility Index currently at 5.94, up 0.13 on the day (YTD: -1.23)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.58, up 0.1 on the day (YTD: -1.1)

- Japanese Yen 1M ATM IV currently at 5.43, up 0.1 on the day (YTD: -0.7)

- Offshore Yuan 1M ATM IV currently at 3.83, down 0.0 on the day (YTD: -2.2)

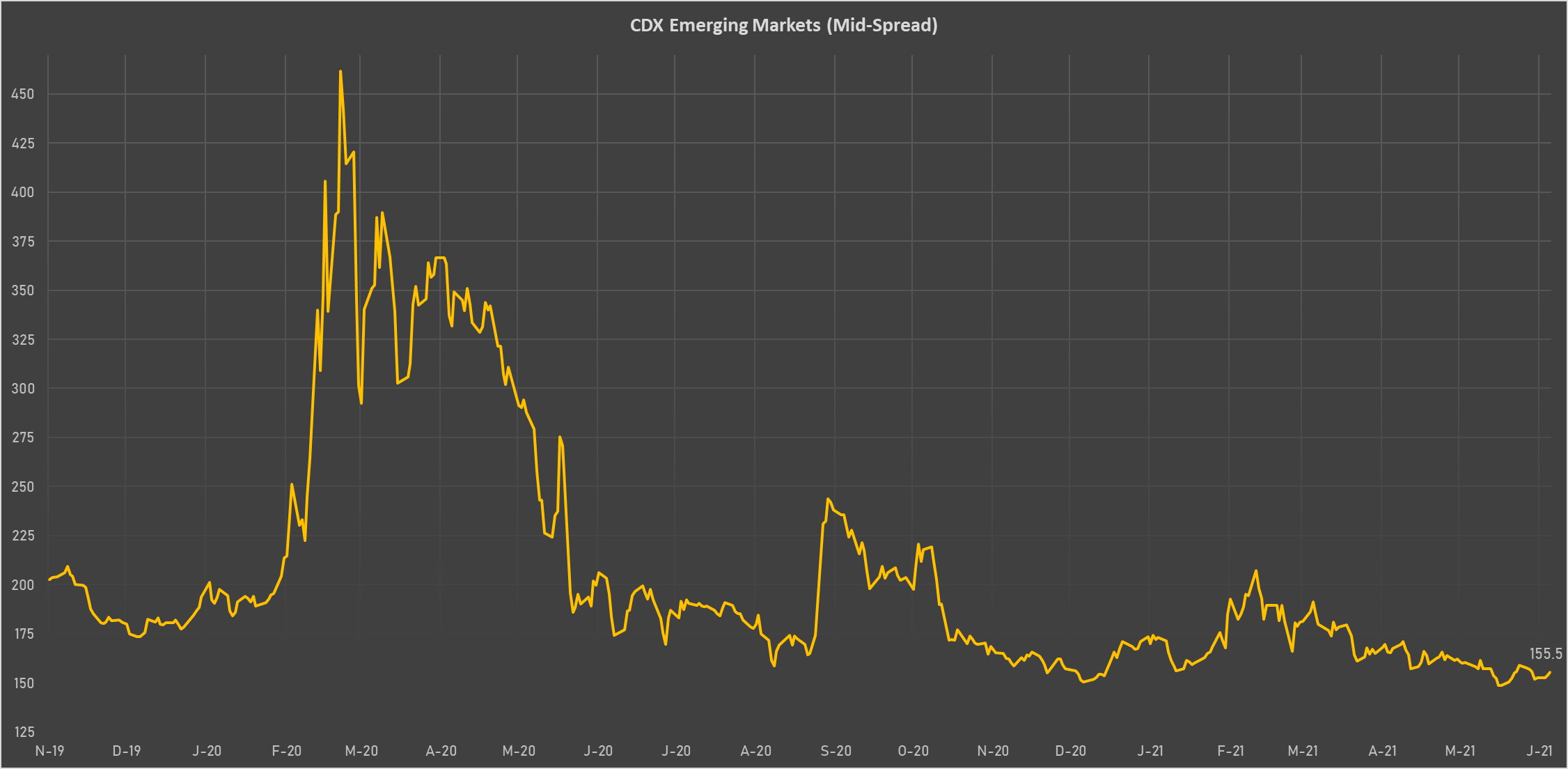

NOTABLE MOVES IN SOVEREIGN CDS

- Brazil (rated BB-): up 5.0 basis points to 165 bp (1Y range: 141-252bp)

- Mexico (rated BBB-): up 1.1 basis points to 93 bp (1Y range: 79-164bp)

- Vietnam (rated BB): up 1.1 basis points to 103 bp (1Y range: 90-173bp)

- Colombia (rated BBB-): up 1.4 basis points to 135 bp (1Y range: 83-164bp)

- South Africa (rated BB-): up 1.7 basis points to 185 bp (1Y range: 178-328bp)

- Pakistan (rated B-): up 2.5 basis points to 383 bp (1Y range: 362-512bp)

- Government of Chile (rated A-): down 0.7 basis points to 57 bp (1Y range: 43-81bp)

- Egypt (rated B+): down 4.5 basis points to 319 bp (1Y range: 283-437bp)

- Bahrain (rated B+): down 5.9 basis points to 191 bp (1Y range: 172-347bp)

- Oman (rated BB-): down 11.4 basis points to 223 bp (1Y range: 226-485bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 2.7% (YTD: -19.7%)

- Seychelles rupee up 1.5% (YTD: +44.8%)

- Honduras Lempira up 1.2% (YTD: +1.0%)

- Norwegian Krone down 0.9% (YTD: -0.3%)

- Polish Zloty down 1.0% (YTD: -2.0%)

- Russian Rouble down 1.1% (YTD: +1.4%)

- Belize Dollar down 1.1% (YTD: 0.0%)

- Colombian Peso down 1.2% (YTD: -8.6%)

- Barbados Dollar down 1.5% (YTD: 0.0%)

- Malagasy Ariary down 3.4% (YTD: 0.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 44.8%

- Mozambique metical up 15.4%

- Argentine Peso down 12.2%

- Turkish Lira down 14.6%

- Haiti Gourde down 19.7%

- Surinamese dollar down 32.2%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 65.6%

- Libyan Dinar down 70.3%

- Sudanese Pound down 87.7%